Brand equity is the currency of trust. Northwestern Mutual stands as one of the national leaders in wealth management, retirement, and insurance. Their rich history and strong reputation has been one of the best for many generations. For brands at this magnitude, the marketing challenge is rarely about initial awareness. It’s about what happens next.

When Northwestern Mutual partnered with Jives, our goal was to leverage the strong brand reputation while adding a surgically, targeted marketing framework to build a pipeline of high-net-worth leads. Together, we worked on developing a performance marketing engine that could operate with precision, identifying and converting individuals who met their ideal client persona (ICP).

This is the story of how we built that engine.

Chapter 1

The Opportunity: Expanding Beyond Brand Awareness

We recognized that while NWM brand attracted widespread attention, each visitor arrived with unique financial needs and questions. However, the site initially was not catered to these unique needs and life stages.

We began by refreshing their digital experience by moving away from a generalized pathway to a more personalized, guided journey. Our mission was to craft personalized website conversion routes that directly addressed individual financial situations.

Chapter 2

The Strategic Blueprint: A Funnel Built on Relevance and Data

We then went to work helping our client shift from a one-size fit all marketing approach to a more dynamic, multi-layered funnel. Our philosophy revolved around meeting each user exactly where they were in their journey, providing relevant and personalized content based on search intent.

Pillar 1: Intent-Based Advertising Precision

Our initial audit highlighted issues around the use of generic terms and broad bidding. Generic bidding on terms like “financial advisor” were not set to maximize acquisition for their ideal clients (HNW individuals looking for specific & niche offerings), so we shifted to a detailed paid search strategy targeting higher intent searches.

Google Ads – Keyword Granularity: We architected an extensive campaign structure targeting longer-tail, high-intent keywords. This meant creating distinct ad groups for queries like “best retirement plans for high earners” or “how to set up a trust for estate planning.” This allowed us to refine marketing and develop ad groups for the highest quality prospect clients.

Personalized Messaging: For each of these ad groups, we crafted hyper-personalized ad copy that directly spoke to the users’ searches. We used ad extensions to highlight specific services and instill confidence by showcasing specific stats, links and social proof.

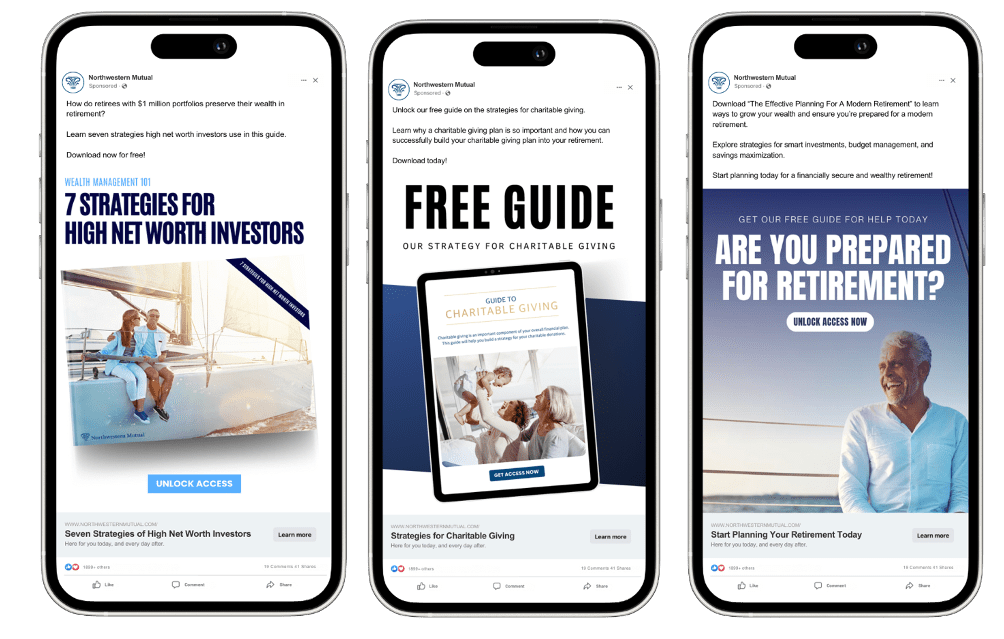

Meta Ads – Value Based Guides: We cross-referenced the learnings from Google PPC to develop targeted Meta ads based on top-converting search terms, with each piece specifically

crafted around the high-intent queries we identified. These valuable resources were then deployed as precision lead magnets across our social advertising campaigns.

Dedicated Landing Page Experience: This was our critical breakthrough. Instead of directing ad traffic to the homepage or a general “Contact Us” page, we created a suite of dedicated, optimized landing pages based on campaigns. A user searching for “family office services for multigenerational wealth” would click our ad and land on a page solely focused on family offices.

These pages featured:

- Targeted Copy: Benefit-driven messaging that addressed the particular concerns of legacy planning and asset protection

- Social Proof: Years of experience, certifications, awards, recognitions

- Contact Forms: An easy to fill out form with necessary fields for sales team to convert intro calls to booked clients

This guided journey from search query to tailored landing page increased relevance and trust, which in turn boosted conversion rates.

Pillar 2: Data-Informed SEO & Content Strategy

Our audit also revealed an opportunity to leverage learnings from paid search to organic search. We re-shaped the content strategy by taking the highest performing paid search terms to rebuild a stronger SEO foundation.

We began by analyzing the highest-converting terms from our paid search campaigns, queries like “estate planning for high net worth” or “retirement strategies for executives.” These data-driven insights revealed what their ideal clients were searching for and which messages resonated most strongly.

With these findings, we developed pillar pages targeting core topics like “Wealth Transfer Strategies”and “Retirement Planning.” Then built a network of supporting content around the specific long-tail keywords we knew converted.Lastly, we created a spider web of interlinking relevant pages, FAQs, and supporting articles to further win SEO rank.

The result was a content approach that worked as a true conversion engine: attracting high-value organic traffic with the questions and needs that Northwestern Mutual’s advisors were uniquely positioned to answer.

Pillar 3: AI-Powered Remarketing

We further modernized Northwestern Mutual’s marketing by pairing re-marketing with AI-driven personalization. Using machine learning models trained on ideal client profiles, we analyzed user behavior to predict intent and readiness.

This enabled two key acquisition levers:

AI Look-Alike Audiences: We built precise audiences modeled after top client characteristics, including HH incomes, financial behaviors, and life stage patterns. These AI generated audience lists then enabled us to efficiently scale reach while maintaining precise targeting.

AI-Personalized Remarketing: We created dynamic content sequences that delivered personalized content based on each user’s specific financial interests and life stage.

The outcome was a shift in engagement quality. This AI-powered approach transformed marketing into a more, personalized financial experience, increasing the flow of qualified leads and booked consultations.

Chapter 3

Conclusion: Engineering High-Intent Client Acquisition

We transformed Northwestern Mutual’s marketing by focusing on three core components: precision intent-based advertising, strategic data-informed SEO and content, and personalized AI re-marketing. This powerful combination created a journey that guided high-intent prospects from initial interest to qualified conversion.

The result was over 400 introductory calls booked and over 1,000 quality leads. Delivering not just volume, but also quality conversions for Northwestern Mutual.

Interested in ramping up your team’s marketing? Contact us today to schedule a complimentary strategy session.